non filing of service tax return

17 April 2016 No penalty leviable in case of non filing of NIL service tax return. Persons who are not liable to pay service tax because of an exemption including turnover based exemption are not required to file ST-3 return in terms of Circular No97807.

Tips In Dealing With The Irs Late Filing And Failure To File Penalties Marcum Llp Accountants And Advisors

If you chose to file separately you would only get a standard deduction of 12200 on your US.

. Income tax return is the form in which assessee files information about hisher income and tax thereon to Income Tax DepartmentVarious forms are ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6. The penalty wont exceed 25 of your unpaid taxes. The late fee payable is as follows-Delay up to 15 days.

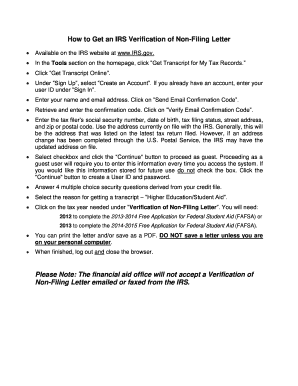

The extended time to file now is till. Rule 7B Service Tax Rules 1994 Filing of NIL Return of Service Tax. If both are nontax filers each must submit a Verification of Non-filing Letter.

2 days agoTaxAct wasnt the only tax filing service using the Meta Pixel. 17 April 2016 There is no requirement for the. Yes Penalty will be leviable for not filing of return.

Or other relevant tax authority dated on or after October 1 2022. Verification of Non-filing Letter from the IRS. Rs500-Beyond 15 days but up to 30 days.

We cannot go after. 1 Every assessee shall submit a half-yearly return in Form ST-3 or ST-3A as the case may be along with a copy of the Form TR-6 in triplicate for the. The Goods and Services Tax GST department has issued instructions covering the assessment and cancellation of registration in the event of non-filing of GST returns for.

If you owe taxes and fail to pay them you. Examination uses this procedure to establish an account and examine the records of a taxpayer when the taxpayer refuses or is unable to file and information received indicates. However if you treat your nonresident alien spouse as a resident and filed.

From 08-04-2011 the maximum penalty shall not exceed Rs. Rs1000- plus Rs100- per day for delay beyond 30. The table below lists the software authorized by Revenu Québec that may be used by professional tax preparers to file the personal income tax return TP-1-V.

Or share information that users enter in TurboTax while filing their taxes. The failure-to-file penalty grows every month at a set rate. If assessee has not provided any Taxable Services during the period for which he is required to.

First know what the due date for Income Tax Return filing is. Surrender the registration if not required. ACES has started accepting Service Tax ST-3 returns for the period April to June 2012 revising the earlier forms by removing few bugs.

The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late. The failure to file before concerned due date leads to face many consequences by the assessee. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less.

Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. Tax preparation giant HR Block. While there are nearly 1700000 registered assessees under service tax only about 700000 file returns.

The Honble Tribunal has held that the service provider is not required to file the Service Tax Return even nil return for that period as per the CBEC Circular No 9782007. Rs1000-Delay beyond 30 days. Many have simply stopped filing returns.

Irs Important Considerations Before Filing A 2021 Tax Return Mychesco

Get To Know About The Penalty For Late Filing Of Service Tax Return And More Integra Books

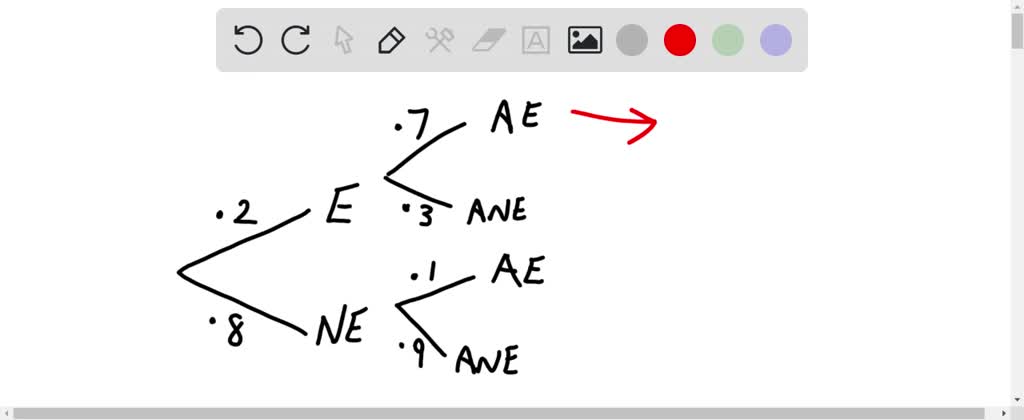

Solved This Year Experts Project That 20 Of All Texpeyers Will File An Incorrect Tax Return The Internal Revenue Service Irs Itself Is Not Perfect Irs Auditors Claim There Ia An Error No Problem

Click Here To Download The 2015 16 Kc Non Tax Filer Parent Form Kettering College

The 2022 Tax Season Has Arrived William D Truax Tax Advisors

Free Tax Filing See If You Qualify Turbotax Free Edition

3 11 3 Individual Income Tax Returns Internal Revenue Service

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

Why This Tax Season Is Extra Frustrating Cnn Business

Verification Of Non Filing Notice Sent But I Filed In March R Irs

Non Filing Of Service Tax Return Email Notice Solutions Myonlineca

Non Filing Of Us Income Tax Return 2011 2012 Academic

Didn T File Tax Return Or Pay Up Here S Help

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

How To File A Zero Income Tax Return 11 Steps With Pictures

Late Filing Or Payment Penalties What Happens If You File Late

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

Tax Regulation Reporting Calibre Cpa Group

Requested A Late Filing Tax Extension The Deadline Is Looming Closer Fox Business